2021 has been a good year for the US wine industry, even great for some. Sales have, in some sales channels, recovered from the difficult 2020. This is one of the conclusions from the Silicon Valley Bank US Wine Industry Report 2022. However, there are several serious challenges looming in the future. Younger generations are not so keen on wine. The wine drinking cohort is ageing. Climate change is also a threat, not least when it affects the water availability for the wine growers. But the SVB has one project in the pipeline to improve the situation, the WineRAMP.

Does this matter for all of us in Europe and in the rest of the world? Yes, it does.

Many businesses have suffered very much under covid. Not so, at least not so much, the US wine industry, according to the recently published State of the US Wine Industry 2022 report (which is, to a large extent, a look back on 2021). This is the twenty-first year that this fascinating report is published by Rob McMillan, Executive Vice President of the Silicon Valley Bank Wine Division (SVB).

Store sales increased and surpassed in some cases pre-pandemic levels, direct-to-consumer sales (DTC) were up, internet sales shot up. And it was a record year for mergers and acquisitions in the industry. And, perhaps most remarkable, one-third of the winery owners think 2021 is their best year ever. Ever!

While the sentiment of many wineries is evidently positive, it is, to some extent, hard to understand why.

This is a longer version of an article published on Forbes.com.

There is no similar report in Europe, but if there were, I think the sentiments would be starkly different. 2021 was one of the worst years ever for wine producers. The three big countries production dropped drastically, -17%. France was hit worst with -27%, almost a third smaller harvest. (More on the global wine production in 2021 in this article.) But the picture is not all gloom in Europe. Champagne reported almost record shipments at 322 million bottles, and the Italian sparkler prosecco reaches record numbers with more than double that in bottlings in 2021 (around 700 million bottles). But back to the US wine industry report and some of its highlights.

While the sentiment of many wineries is evidently positive, it is, to some extent, hard to understand why.

“The US wine industry had pockets of success in 2021, but it’s increasingly obvious that wine as a product has lost the luster it once had with the consumer 20 years ago and is probably entering a phase of negative volume growth. For 2022, we should still see positive sales on a value (dollar) basis.” (The SVB US Wine Industry Report 2022)

Looking forward

Let’s first look at the predictions, what will the 2022 bring for the US wine industry?

Here are some of the key points:

- Sales are likely to decline, at least on a three-year horizon

- “Analysts disagree on year-end total sales of wine. But within three years, we believe declining sales by volume will be accepted as reality by all analysts.” (The SVB US Wine Industry Report 2022)

- Lower prices ranges will face the most challenges, premium wine will be spare, for the moment

- The wine-consuming customer will get, on average, older, one of the major challenges for the industry, since younger people are less enthusiastic about wine

- “The median age of baby boomers, who drove success in the industry over the past 23 years, will hit normal retirement age in 2022.”

- “The challenge of recruiting younger, health-conscious, multicultural consumers into the wine category, combined with the aging of the older core wine consumer, remains.” (The SVB US Wine Industry Report 2022)

- Access to water will become more difficult and producers will have to think about solutions

- In the West, the impact of drought will likely become a focal point of industry discussions and planning in 2022, particularly if there isn’t substantial rain and snow before the spring in California. With increasing climate impacts from drought, fire, low soil moisture and record low reservoir levels, there will be even more pressure for agriculture and residential users to share limited water.

- “Water could become the most important discussion topic, perhaps as early as this year” (The SVB US Wine Industry Report 2022)

- There will still be some over-supply (of grapes and bulk)

- Wineries that sell a big part of their production at the cellar door will have to rethink

Let’s then look at the analysis of what happened in 2021.

2021 Sales… flat

The SVB estimates that sales were essentially stable in 2021. They estimate the change in volume sales to be between -2% and 0% and counted in value between 0% and +2%. However, it isn’t easy to estimate since there have been so many movements between sales channels. 2020 was, of course, marked by radically restricted sales in restaurants and bars. Instead, many producers jumped on to the opportunity of developing online sales, which grew significantly. 2021 does not necessarily see a reversal of that.

Wine is not invited to the party

The SVB had predicted at the beginning of the year that as covid restrictions started to ease, people would celebrate. And that this would lead to an increase in consumption. Well, people did celebrate, but they did not celebrate with wine. As the SVB puts it, “wine (…) wasn’t invited to the party”.

Equally important, if not more, is the data on wine consumption per capita. These numbers do not include 2020 and 2021, but they show a very concerning trend. Since the early 90s, wine consumption per person has increased in a steady and quite rapid pace. It almost doubled over just under 25 years and peaked in 2014. Since that peak it has declined substantially and is back at a level similar to 2010. Meanwhile, spirits show a steady upwards trend.

Wine is not cool

One of the key messages in the analysis is that wine is losing market share to other alcoholic beverages and also to non-alcoholic beverages. Wine is not cool.

Wine has had a stable market share of total alcohol consumption in the US of around 18% since 2011. In 2020 it dropped almost one percentage point, from 18.1% market share to 17.3%, the biggest shift since before 2002. The winner is spirits, which have grown its market share from 29.1% in 2002 to 37.8% in 2020.

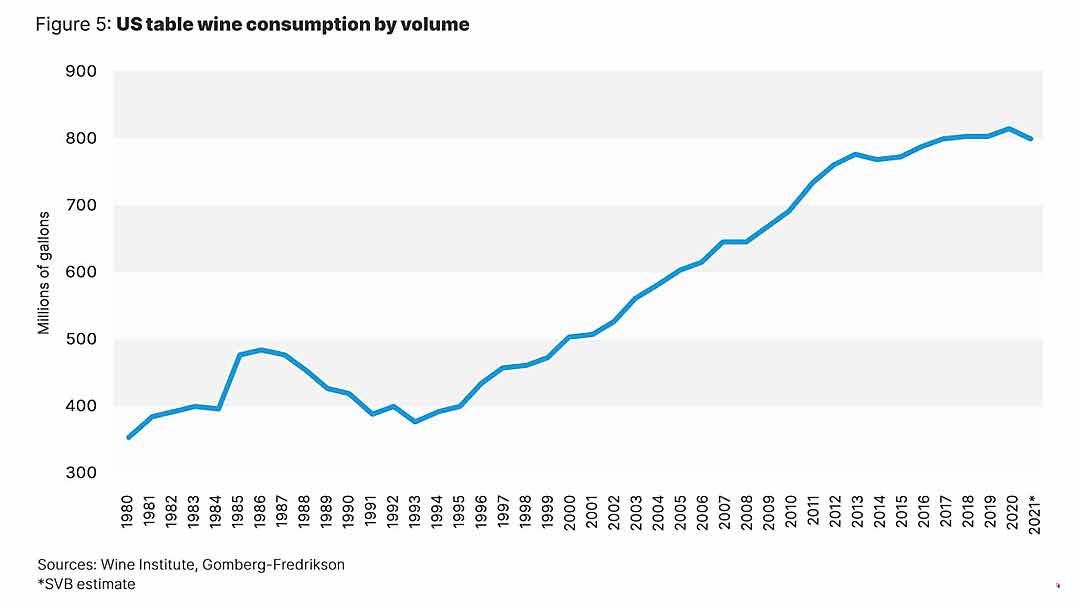

That is also reflected in the US table wine consumption. Between 1993 and 2013 it saw steady growth from around 400 million gallons at the start to almost 800 million gallons at the end. Since 2014 (a year of decline), the growth has been much slower, just edging up over 800 million gallons. The SVB estimates that consumption will again decline in 2021 and drop below 800 million gallons.

Wine is for the well-off and old(ish)

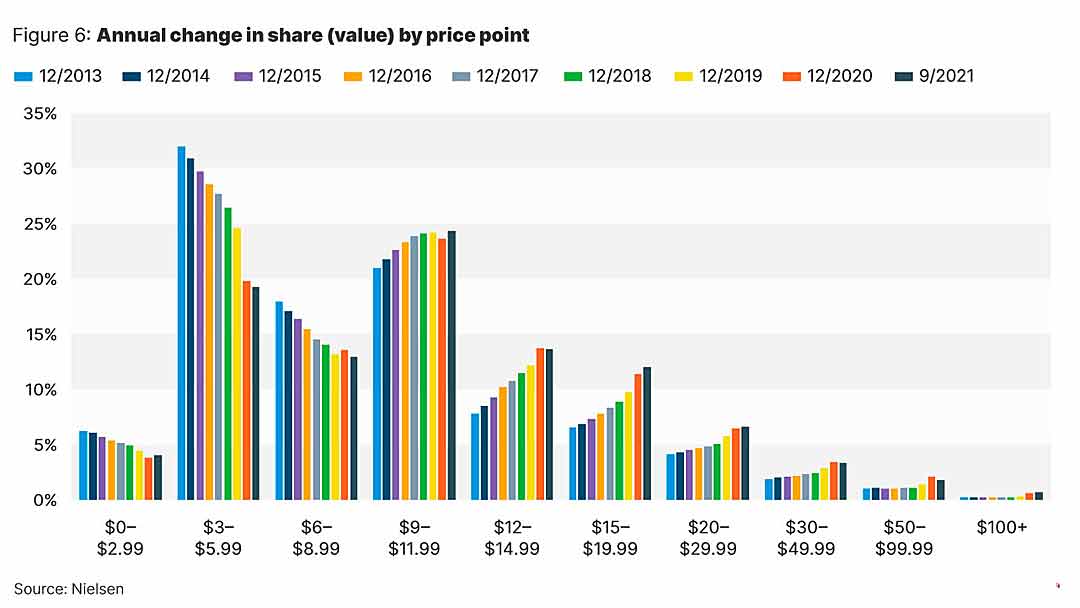

One not so gloomy part of this picture is that there has been a very clear shift to higher-priced wines. Wines for $8.99 and less has lost market share, from around 57% market share in 2013 to approximately 36% market share in 2021 (off-premise sales). The segment between $12 and $29.99 has gained the most.

This is, of course, a good thing. But also a bad thing, because one of the reasons this shift is happening is that wine-drinkers are spending more dollars on the bottles because they are getting wealthier and older.

Wine is not attracting younger consumers as it used to.

“Today, wine isn’t the next generation’s preferred alcoholic beverage.” (The SVB US Wine Industry Report 2022)

As an illustration of this, on the question “What would you bring to share at a party?” half over-65s (49%) answered wine. For the age bracket 21-34, only 15% said wine, with higher scores for beer, spirits, flavoured malt beverage, and hard seltzer. Looking at these numbers, one would not say that the future looks bright for wine as the young grow older. But to really understand if this is the case, one has to look at other factors. For example, has this always been the case, perhaps? That the young do not drink much wine, and as they grow older, they get a taste for it? A deeper analysis would be interesting.

“While the good news is that the boomer consumer is still buying, the bad news is that we still aren’t connecting with newer consumers’ values. The inability to react to the declining volume of entry-level wines will only mean that fewer consumers will prefer wine as their alcoholic beverage of choice over time.” (The SVB US Wine Industry Report 2022)

The roller-coaster of retail and restaurant sales

In many ways, it would make more sense to compare the situation in 2021 to 2019. The year in the middle, 2020, was thoroughly marked by the pandemic and stay-at-home recommendations, making for a problematic or skewed starting point for any comparison.

In 2020, retail sales (off-premise/off-licence) shot up compared to 2019. People did not go to restaurants. Instead, they consumed wine at home, maybe even stockpiled. Throughout the year, retail sales were doing very well. (A similar development was seen e.g. on the Swedish monopoly market where the monopoly retail chain, Systembolaget, reported strong sales in 2020.)

Then came 2021, and the opposite happened. Retail sales dropped. But not as much as they had gone up in 2020.

The restaurant trade in wine shows, of course, the opposite pattern—a dramatic drop in 2020 and at least a partial recovery in 2021. But only partial; 2021 has still been a challenging year for restaurants and for wine sales in restaurants. The sector has also shrunk. The SVB notes that more than 10% of restaurants are thought to have closed due to the pandemic.

Are restaurants out-pricing wine?

Another issue affecting wine sales in restaurants is the price evolution. Wine has become comparatively more expensive in restaurants and bars, driving consumers towards other drinks, mainly spirits. Wine is no longer the self-evident choice of drink to a meal. “Unless some solution is found, there is every reason to believe wine will continue to lose share to spirits and other beverages in the on-premise channel,” the SVB notes. More on the “solution” later.

“A perfect storm of challenges — price increases, the uneven exchange of older wine-loving consumers for younger spirits-loving consumers, reduced space on beverage lists, added competition from seltzers and RTDs, the growing gap between the price in grocery stores and the marked-up price in restaurants, and spoilage — is making spirits an increasingly preferred choice over wine in restaurants, particularly for the large swath of frugal consumers under 40.” (The SVB US Wine Industry Report 2022)

Online sales doing very well indeed, thank you

Online sales boomed in 2020, with an increase of 32% compared to 2019. It reached almost 10% of total sales. Would 2021, with society slowly creeping back to “normal”, mean that internet wine sales fell to pre-pandemic levels?

It did not. The share of online sales as a percentage of total sales did shrink, but only a tiny bit, from 9.8% to 9.1%. Consumers continue to buy wine online. The SVB speculates that we may be seeing a permanent shift in buyer behaviour, with more wine purchased online. That seems to be a reasonably safe bet. We have seen a general shift to more online sales for a long time. There’s no reason to think that wine would be different.

The respondents to the SVB survey are also planning to increase their investments in the digital channel.

Times are great!?

Perhaps the most remarkable finding in the SVB report is that wineries think times are good, and not only that, they say they’re doing great. A tidal shift from 2020.

In 2020, 41% of wineries who responded to the SVB poll said that it was one of the most challenging years ever, or even the most challenging.

In 2021, the picture was diametrically opposite: 53% say it is one of the better years or the best year in their history. 29% said it was the best year ever! The best year ever, not just better than the catastrophic 2020.

What has happened?

The SVB doesn’t really give any responses to the question.

But they do present some interesting data. An astonishing number is the sales growth rate for “premium” wineries, premium here being an ad-hoc definition, based on data collected by the SVB. Their sales growth in 2021 was 21%, the best since 2007. Their average case price went up drastically from 2020, a year of discounting, to the best since at least 2015.

The demographic alarm bells are ringing

The younger generations don’t see wine as the obvious choice to drink for dinners or parties, as mentioned before. The SVB considers this as a huge problem. Or rather, A HUGE PROBLEM.

“Unless the industry does more to attract consumers younger than 65, wine consumption might drop by 20 percent when boomers sunset.”

(The Boomer generation refers to people born between 1946 and 1964, in other words people who today are between 57 and 75. They are followed by X, millennials and Z.)

The USA is still the world’s biggest wine consumer, drinking 33 million hectolitres in 2020, according to the International Organisation of Vine and Wine (OIV), a year with zero growth. This follows a long period of good growth numbers. In 2000 the US consumed only just over 20 million hectolitres. In 2013, thanks to its rapid growth, the USA became the world’s biggest wine market, overtaking France.

Will the OIV figures for 2021, soon to be published, confirm the decline?

The bank points to one big issue: the wine industry is failing to attract the younger generations, failing in their marketing messages. The wine industry needs to come up with messages on issues like ethnic diversity, climate change and global warming, health and well-being, social justice, the environment and green issues and other themes that are important for the young people today, according to their analysis.

“The US wine industry isn’t doing a good enough job of marketing and selling its product, often remaining wedded to successful strategies from the past while the culture, country, business environment and consumer have radically evolved. It’s flat-out not good enough, and the overall industry results show it.”

“If we really want to reach the millennial, we need to move away from lifestyles of the rich and famous and add cause-based marketing to our outreach. We need to hire more people in tasting rooms with tattoos and with different ethnicities. We need to promote our efforts at being carbon- neutral and our support for social justice.” (The SVB US Wine Industry Report 2022)

A crisis not only for the US wine industry?

The declining US consumption is a critical message for the US wine industry but the consequences are so far-reaching that it should be a concern for the global wine industry.

As noted above, the US is the world’s biggest wine market, the biggest wine consumer. If consumption is flattening out or even decreasing in the long run wine producers all over the world will have to think hard about which markets to focus on.

This comes at a time when another of the world’s biggest wine markets have become a cause for concern: China. The Chinese market has for many years been seen as one of the big opportunities to grow wine sales. It has even become the biggest export market for Bordeaux wine. But that picture is changing. In 2020 the Chinese wine consumption slumped -17.4%, the third year in a row of declining consumption.

So if both the USA and China, two of the world’s biggest markets, are losing interest in wine, where should producers look for opportunities?

Grape and wine over-supply

The US has seen two years of small harvests. But, despite that, grape and bulk wine prices have not gone up. The conclusion seems to be that stock levels are still satisfactory (or more), and the producers are not predicting an increase in demand (consumption).

Looking back, the harvest volumes have seen at least four decades of steady growth, from 1.5 million tons in 1977 to 4.3 million tons in 2018. The grape crush is now down 20% from that peak.

The SVB quotes Jeff Bitter, president of Allied Grape Growers, arguing for reducing the acreage planted with wine. Grub up vineyards. This seems to be a clear indication that there is currently an over-supply of grapes. However painful the recent wildfires on the West Coast were, they must somewhat have alleviated the over-supply.

Or perhaps consumers can look forward to a period of lower wine prices if the abundance of grapes (and bulk wine) continues?

Turning water into wine

Another big challenge, especially in California, is access to water. California has suffered drought years, leading to some producers losing their water supply. But much of the water is piped from far away or even out-of-state. This is increasingly questioned, and supply is becoming less secure. 43% of growers are very concerned, predicting potential severe shortages.

This is yet another factor of the importance of sustainability and global warming that the SVB points to.

The industry is clearly aware of the issues. But what do they intend to do about it? Stop irrigating? Plant less water-demanding grape varieties? Buy more water? The SVB asked the question and the three top answers from the wineries were:

- Use new technology to reduce water demand

- Nothing planned for 2022

- Drill a new well

This may be satisfactory for the short term but it certainly does not look like a long term strategy.

“Grape varieties” going up and down

The report shows an interesting picture on the demand for different grape varieties (or “varietals” as they say). American wine production and wine consumption is very focussed on grape variety identification. They show a curious picture mixing varieties and wine styles.

The five top “grape varieties”, in market share, are:

- Chardonnay

- Cabernet sauvignon

- Red blends

- Pinot grigio

- Sparkling, other

Or if we talk proper grape varieties:

- Chardonnay

- Cabernet sauvignon

- Pinot grigio

- Sauvignon blanc

- Pinot noir

No real surprises there. What is noteworthy is that all top grape varieties show a negative growth rate. There are only three categories that show a positive growth rate, from the top:

- Prosecco

- Sparkling, other

- Speciality

I am not quite sure what prosecco refers to here, if it is real Italian prosecco or if it is a US-made imitation of it. It certainly rhymes with the astonishing record of some 700 million bottles prosecco bottled in Italy in 2021. “Specialty” includes fruit-infused wines. Perhaps it also includes the less common varieties, which in that case is a good sign for a broadening of consumer tastes to new varieties.

An on-ramp to revive the wine industry

It is a curious contradiction how the wineries see 2021 as a very good year, for many even the best ever, contrasted with the gloomy picture painted by the SVB. In particular, the bank is very worried about wine falling behind and being forgotten by younger consumers. The wine industry as a whole is not doing a good job of marketing to new consumers.

But instead of being just worried, Rob McMillan, the author of the SVB report, has decided to do something about it. Together with a few key colleagues in the US wine industry, he has launched a project to develop a new marketing program for the industry, addressing many of the issues that they see in the current situation. They hope to raise money from all over the wine industry for this research and promotion project, aptly named The WineRAMP, to get new customers onto the on-ramp to wine. I wish them luck and success.

You can download the wine report on the Silicon Valley Bank web site.

Consequences for Europe?

SVB’s analysis is exclusively about the USA. But there are good reasons for us in Europe to take a close look at what they say.

First, the US market is so large, the world’s largest wine market, so what happens there inevitably has consequences for wine producers and wine consumers in the rest of the world.

But in addition, many of the trends and developments that the SVB describes, we can also see in Europe. For example, that younger generations seem to be more interested in drinks other than wine, not least spirits, in the form of mixed drinks, cocktails and other things. And climate change, with e.g. potential water shortage, is also something that inevitably happens here as well.

So there are good reasons for us in Europe to seriously consider what they say.

Travel

Why not go and take a look at the world’s vineyards for yourself? Come and visit a vineyard and learn more about wine production and wine consumption? You can do that on a wine tour with BKWine to one of the many wine growing countries in the world.

Travel to the world’s wine regions with the wine experts and the wine travel specialist.

Wine tours that give you insight. BKWine wine tours.

2 Responses

This was a fantastic summary write-up. Found it posted over in facebook. I’m headed over to read about WineRAMP. I thought the slumping sales in inexpensive wines as an indicator of problems for the industry later on because the industry failed to induct new drinkers was intriguing.

At some point our market will mature. It’s just a question of time.

Thank you. It’s interesting to see how sometimes data is a good illustration/confirmation of trends.